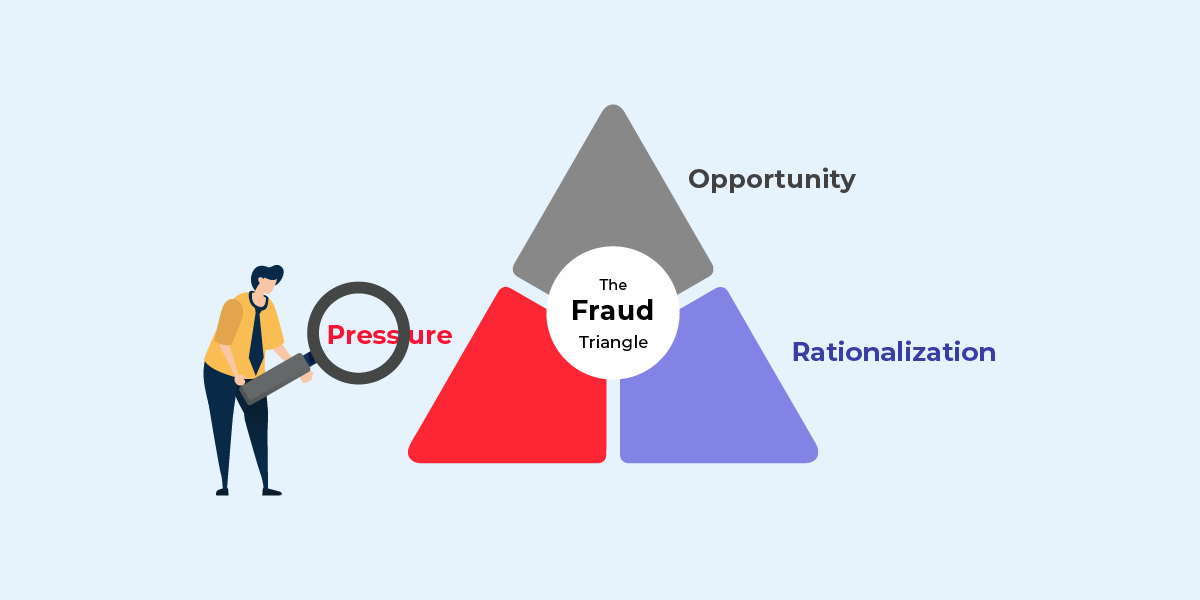

In the 1970s, criminologist Donald R. Cressey published a model called the “fraud triangle”. This model focuses on his research of people who were caught embezzling. There are three elements that made up his model; opportunity, pressure, and rationalization.

Using this model, we are able to gain an understanding of the factors that contribute to fraudulent behavior. Firstly, opportunities arise when someone has the chance to commit fraud without detection. Then, we have pressure that points to a motivation or need for committing fraud. Lastly, there is rationalization or the justification for engaging in fraudulent activities.

Understanding and addressing these elements can help mitigate the risk of fraud in various contexts.

Fraud Triangle Element 1: Opportunity

Opportunity is defined as the circumstances or conditions that make it possible for someone to commit fraud. This is the critical element, as without the right conditions, fraud may not occur. When the opportunity arises, individuals are able to exploit weaknesses in internal controls, manipulate processes, or take advantage of lapses in oversight.

Weak Internal Controls

- Lacks robust internal controls.

- Loopholes in its systems.

- Provides an opportunity for fraudsters to exploit these weaknesses.

Inadequate Oversight

- Limited supervision or inadequate monitoring.

- Create opportunities for individuals to engage in fraudulent activities without detection.

Access to Assets

- Individuals with access to valuable assets or sensitive information may find opportunities to misappropriate funds or manipulate financial records.

Fraud Triangle Element 2: Pressure

Pressure is defined as the perceived financial or personal need that drives an individual to commit fraud. Pressure can take various forms and may include:

Financial Difficulties

- Personal financial problems, such as mounting debts, gambling losses, or unexpected expenses.

- Can create a sense of desperation.

- Individuals facing significant financial pressure may be more inclined to commit fraud as a way to alleviate their financial difficulties.

Lifestyle Expectations

- Some individuals may be under pressure to maintain a certain lifestyle or meet societal expectations.

- This could include the desire to own expensive possessions, travel, or provide for their family at a level beyond their means.

Addictions

- Individuals struggling with addictions, such as gambling, substance abuse, or compulsive spending, may experience intense financial pressure.

- Fraud might be seen as a means to fund these addictive behaviors.

Personal Crises

- Personal crises, such as medical emergencies, divorce, or the loss of a job, can create significant financial strain.

- Individuals facing such crises may feel compelled to commit fraud to address immediate financial needs.

Fraud Triangle Element 3: Rationalization

Rationalization is defined as the cognitive process by which individuals justify or make excuses for their fraudulent behavior. When individuals engage in fraud, they often need to reconcile their actions with their own sense of ethics, morals, or societal norms.

Rationalization involves creating justifications or excuses that allow the person to convince themselves that their fraudulent actions are acceptable or necessary.

Denial of Victim

- The individual may convince themselves that the organization or person being defrauded is not really being harmed or will not suffer significant consequences.

Entitlement

- Some individuals may feel a sense of entitlement, believing that they deserve the funds or benefits they are obtaining through fraudulent means due to perceived mistreatment or unmet expectations.

Necessity

- Individuals might rationalize fraud by convincing themselves that they have no other choice due to extreme circumstances, such as financial difficulties or personal crises.

Blaming Others

- The person may shift blame onto others, either within or outside the organization, to justify their actions.

- They may see themselves as victims of circumstances beyond their control.

Ethical Fading

- Individuals may engage in a gradual erosion of ethical standards, allowing them to rationalize fraudulent behavior as a series of small, justifiable actions rather than recognizing the overall misconduct.

Strategies to reduce fraud

For organizations in general

- Organizations should not only focus on reducing opportunities for fraudulent behavior but also work to create a strong ethical culture.

- Promoting a culture that supports employees facing financial difficulties where employees feel comfortable discussing their challenges.

- Providing support programs to deter individuals facing pressure from engaging in dishonest actions.

- Fostering a culture of integrity and ethical behavior within the organization.

- Implementing strong internal controls and monitoring financial activities to reduce the opportunity for fraudulent behavior.

- Establishing clear policies and procedures by conducting regular audits.

For E-commerce merchants

Fraudsters love change because it provides them with opportunity. When the world is faced with confusion and chaos such as during the throes of the pandemic, fraudsters are provided with plenty of opportunities to commit fraud.

To help mitigate the risk of e-commerce fraud:

Implement Secure Payment Systems

- Choose reputable and secure payment gateways.

- Implement two-factor authentication for transactions to add an extra layer of security.

- Regularly update and patch payment processing systems to address vulnerabilities.

Use Address Verification System (AVS)

- Enable AVS to verify the billing address provided by the customer with the one on file with the credit card issuer.

- Flag or review transactions with address mismatches to prevent potential fraudulent orders.

Employ Device Identification and IP Geolocation

- Utilize device fingerprinting and IP geolocation to identify and track customer devices.

- Flag or review transactions with unusual device or location patterns, as these may indicate fraudulent activity.

Monitor Unusual Buying Patterns

- Set up alerts for unusual buying patterns, such as a sudden increase in order frequency or high-value transactions, a.k.a. fraud velocity.

- Monitor for multiple orders using the same credit card but with different shipping addresses, a.k.a. carding attempts.

Require Strong Passwords and Encourage Two-Factor Authentication

- Encourage customers to create strong, unique passwords for their accounts.

- Implement two-factor authentication for customer accounts to enhance login security.

- Regularly prompt customers to update their passwords and enable additional security features.

Bonus Tip

FraudLabs Pro can severely curtail fraudulent orders on online stores with the features above and so much more. It uses geolocation validation, device fingerprinting, proxy detection, email validation, and more, to assess the risk associated with each transaction. Even the free plan can protect the online merchants from common fraudulent patterns.

Conclusion

Unfortunately, fraud is a common occurrence in business. It is difficult to stop all instances of fraud. Knowing the thought process behind those who commit these crimes may help companies implement strategies to reduce fraud in the future.

Free Fraud Protection Today!

Start safeguarding your business with FraudLabs Pro Fraud Prevention at Zero Cost!