Online stores have always encountered fraud cases when it comes to e-commerce transactions. The only difference is that with the pandemic, more and more people started buying things online. As a result, fraud cases have risen significantly as well.

Smaller merchants may find themselves struggling to vet all online order transactions in real-time. When the number of transactions exceeds the manpower available to review orders for fraud, that’s when the business will suffer.

A higher number of fraudulent transactions means financial losses. Fortunately, newer technologies can help to mitigate the frauds, as long as the merchants understand the importance of an evolving fraud prevention system.

What is fraud prevention system

As mentioned, technology plays a key part in any fraud prevention system. Frequently, such a system will be integrated within the payment or checkout process. It will automatically screen all order transactions in real-time to detect and prevent fraudulent activities from occurring.

The best part of using an automation vs. humans to check for fraud is that it takes a tiny fraction of the time a human would need to conduct all the relevant checks. Any suspicious transaction can then be flagged for a review by a human, severely reducing the manpower required. A fraud prevention system can screen details like the IP geolocation of the online customer, their billing or shipping addresses, their payment card info and so much more. Merchants can just view the screening results via online dashboards and take actions to release or reject orders effortlessly.

A good fraud screening tactic also involves authenticating the identities of the purchasers before allowing them to buy anything. The 2-factor (2FA) or multi-factor (MFA) authentication is commonly used for that purpose. The end user will be sent a code to their mobile phone and they will have to input it into the website to proceed with purchases.

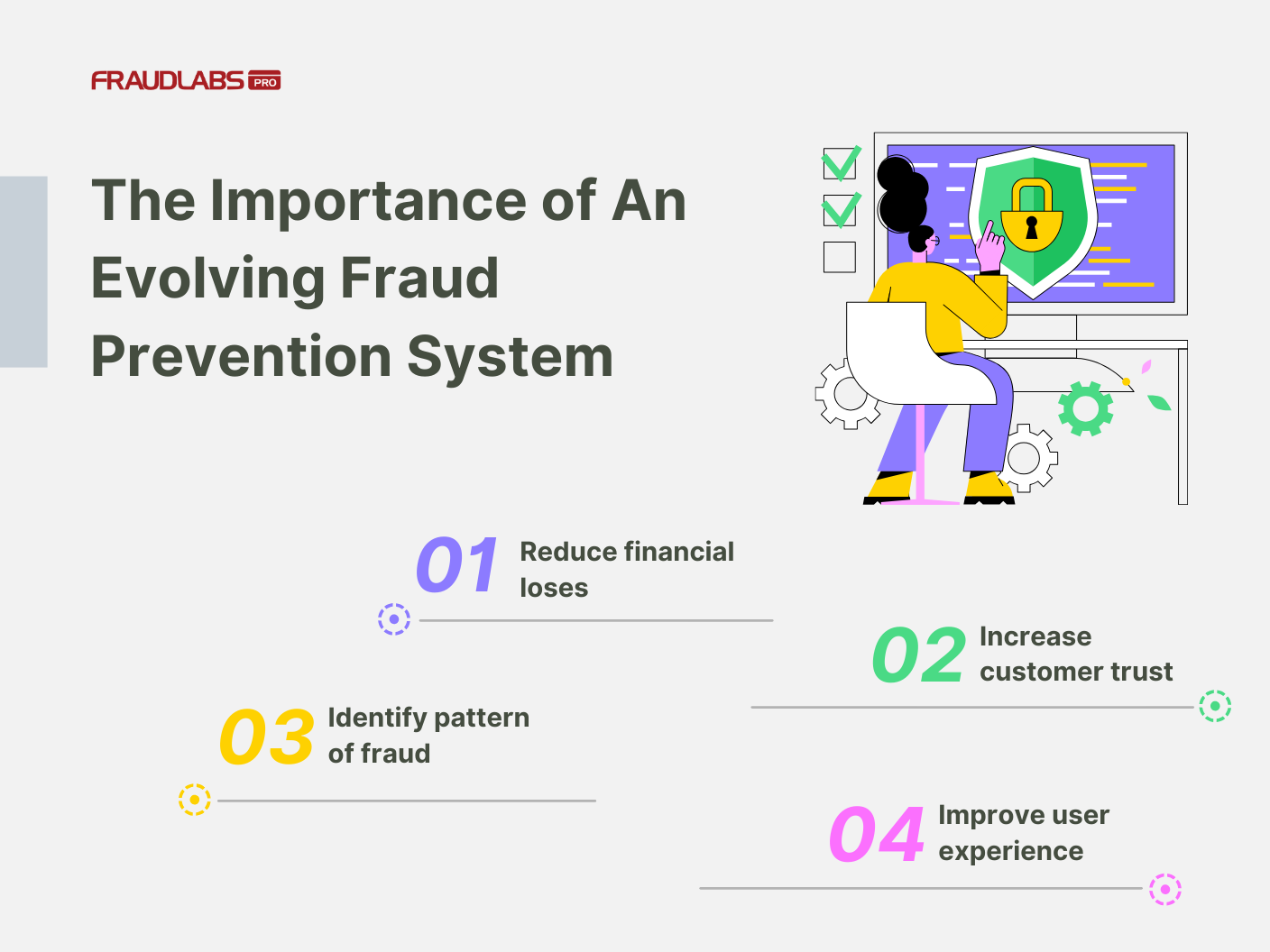

The importance of an evolving fraud prevention system

Reduce financial loses

Using a good fraud prevention system brings lots of benefits to the merchants. Less fraudulent orders that go through means less chargeback penalties to be incurred. Merchants keep more of their revenue instead of losing money to fraudsters. Good fraud checking and prevention strategies can prevent unauthorized access to customers’ accounts. In addition, all the detailed fraud screening done can unveil fraudulent transactions and stop them before they go through.

Increase customer trust

Sometimes, there are just so many online merchants offering the same products and services. What sets a merchant apart is the trust of their repeat customers. In order to increase customer trust, merchants need to provide a secure and reliable platform for the customers. When the customers enjoy peace of mind while doing their shopping, that is critical for building trust and customer loyalty.

Identify pattern of fraud

With the help of a good fraud prevention system, the real-time screening done on transactions can quickly uncover anomalies accurately. Anomalies are usually fraudsters making big or multiple transactions. The automated nature of the screening means that the fraudsters can be stopped with little or no human involvement. Merchants can always review the order screening details later via the dashboard and tweak their fraud criteria if necessary.

Improve user experience

People are naturally impatient, hence any delay in fulfilling their order purchase can deter them from future purchases. They may also abandon their checkout process mid-way through. They demand convenience and ease of use in their digital interactions. Using automated fraud checks, protects the merchants from fraud while still allowing the users to go about their purchases without any interruptions. Giving people a seamless and secure user experience is a must if any online businesses wish to have any corporate longevity. Increase the customer satisfaction and they’ll keep coming back to your store.

Consequences of no fraud prevention

Imagine selling someone an item and then finding out that it’s a fraudulent order. Merchants lose both the product and the money. How long can a business keep this up before facing serious financial ruin? Without a good fraud prevention system, merchants will lose money, customers as well as their reputation. Not to mention the financial penalties if the user’s personal information is compromised.

Conclusion

Fraud prevention is important for businesses due to the rise of sophisticated fraudsters and their crafty tactics. Businesses need to take a holistic approach that considers the latest trends and techniques used by fraudsters. A good step is to use the fraud screening service by FraudLabsPro which protects thousands of merchants worldwide from fraudulent orders round the clock. Merchants can always start with the Free Micro plan and then upgrade if necessary for more protection.

Free Fraud Protection Today!

Start safeguarding your business with FraudLabs Pro Fraud Prevention at Zero Cost!