In today’s digital era, the threat of identity theft is more significant than ever. The rise in online transactions, social media engagements, and digital interactions have heightened the vulnerability of personal information to malicious actors.

It results in severe consequences for victims, ranging from financial hardships and damaged credit scores to emotional distress. By understanding what identity theft is, its common tactics and ways to prevent it, we can safeguard ourselves from this pervasive threat.

What is identity theft

Identity theft happens when an individual acquires and utilizes someone else’s personal information, like name, social security number, credit card details, or other identifying data for fraudulent activities.

Common tactics used by identity thieves

Identity thieves employ various tactics to gather personal information and exploit it for their personal gain. Being aware of these tactics can enable individuals to identify possible risks and proactively protect their identities.

Phishing Emails or Text Messages

Scammers attempt to trick users by sending fraudulent emails or messages posing as legitimate institutions, such as banks or government agencies. These messages often request personal or sensitive information, such as passwords or credit card details, under the guise of urgent notifications or account updates.

Card Skimming

Card skimming occurs when small devices are used to collect credit card details during valid transactions, like at ATMs or gas stations. The obtained information is later used to produce cloned cards or carry out unauthorized transactions.

Data Breaches

Data breaches occur when cybercriminals breach organizations’ databases to steal significant amounts of personal data. This stolen data can then be either sold on the dark web or utilized for identity theft against unsuspecting victims.

Dumpster Diving

Scammers can use old-fashioned tactics to steal sensitive information instead of relying on technology. They search through trash (commonly known as dumpster diving) to locate documents that may contain personal details like bank statements or utility bills.

Ways to prevent identity theft

It may not be 100% possible to avoid identity theft. However, by taking the precautions listed below, individuals can limit the potential damage that can be done. Let’s delve into the precautions below.

Safeguard Personal Information

Exercise caution when sharing personal details online and offline, including being mindful of information shared on social media. Using a shredder for important documents adds an extra layer of security by preventing sensitive information from being obtained through dumpster diving.

Secure Digital Information

Utilize strong, unique passwords and two-factor authentication to safeguard online accounts. Password managers can assist in creating and storing complex passwords for multiple accounts, reducing the risk of unauthorized access.

Monitor Accounts

Regularly check financial statements, credit reports, and other financial documents. Reporting any suspicious activity promptly can prevent further harm and aid in investigating identity theft incidents.

Protect Email and Physical Mail

Email is frequently targeted by identity thieves. Enhance email security and opt for paperless billing to lower the chances of sensitive information being intercepted from your physical mailbox.

Limit Information Shared on Social Media

Use common sense regarding the information shared on social media platforms and tailor privacy settings to limit exposure of personal data. Refrain from sharing sensitive details, like full birth dates or home addresses, in public posts.

Stay Educated

Stay informed about the latest identity theft tactics and scams. Educate family members, especially seniors who are often targeted, about how to recognize and avoid potential threats.

How FraudLabs Pro helps merchant to prevent identity theft frauds

Identity theft is also a thorn in the side of online merchants. They have to bear financial losses due to refunds or chargebacks if a fraudster uses another person’s info to make a purchase on the online stores. Merchants need to use fraud prevention service like FraudLabs Pro to automate order screening for identity theft.

FraudLabs Pro has many fraud screening components that work in unison to provide an effective and robust fraudulent order protection for online stores. Merchants being protected by FraudLabs Pro can access real-time blacklist data contributed by other merchants from around the world. Easily block a stolen identity with the live data.

In addition, merchants can use the FraudLabs Pro custom rules to prevent identity theft. Among the useful rules is the IP geolocation vs. credit card country matching rule. FraudLabs Pro also incorporates device fingerprinting to pinpoint fraudsters even if they change their IP address or email address.

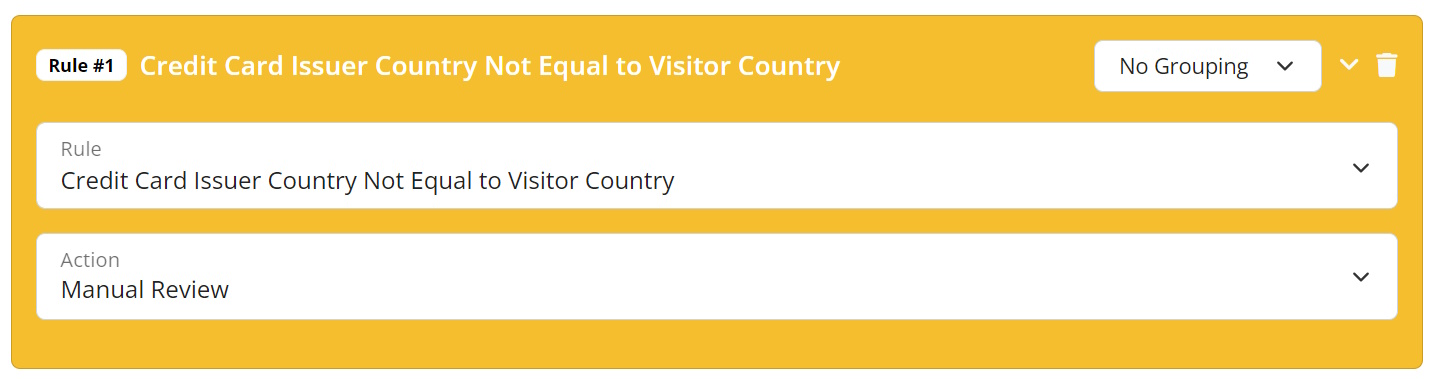

Use Card Country Not Match with Visitor Country Rule

If the credit card issuer country is not equal to the visitor country, this may be an indicator of fraud.

E.g., The card was issued in the US but the shopper’s IP is in Singapore.

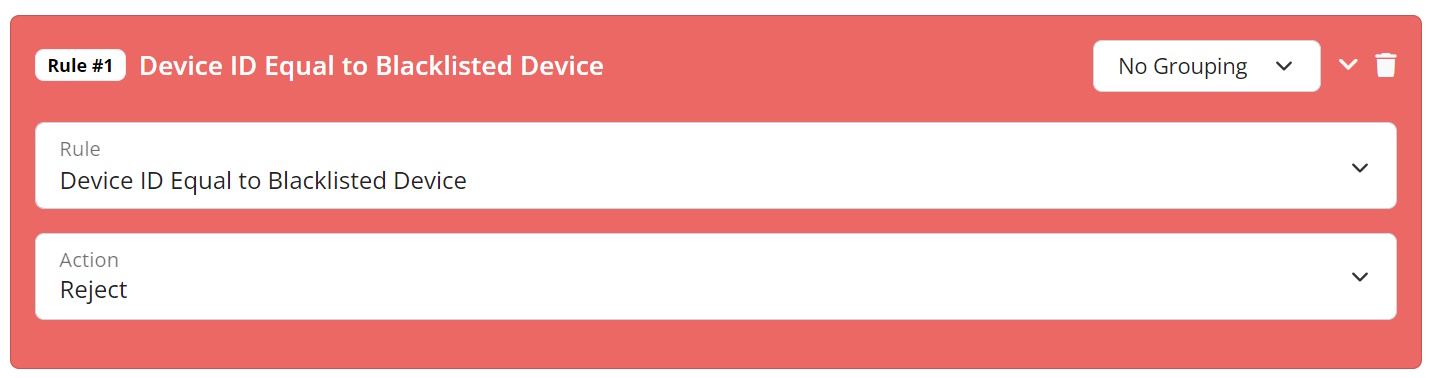

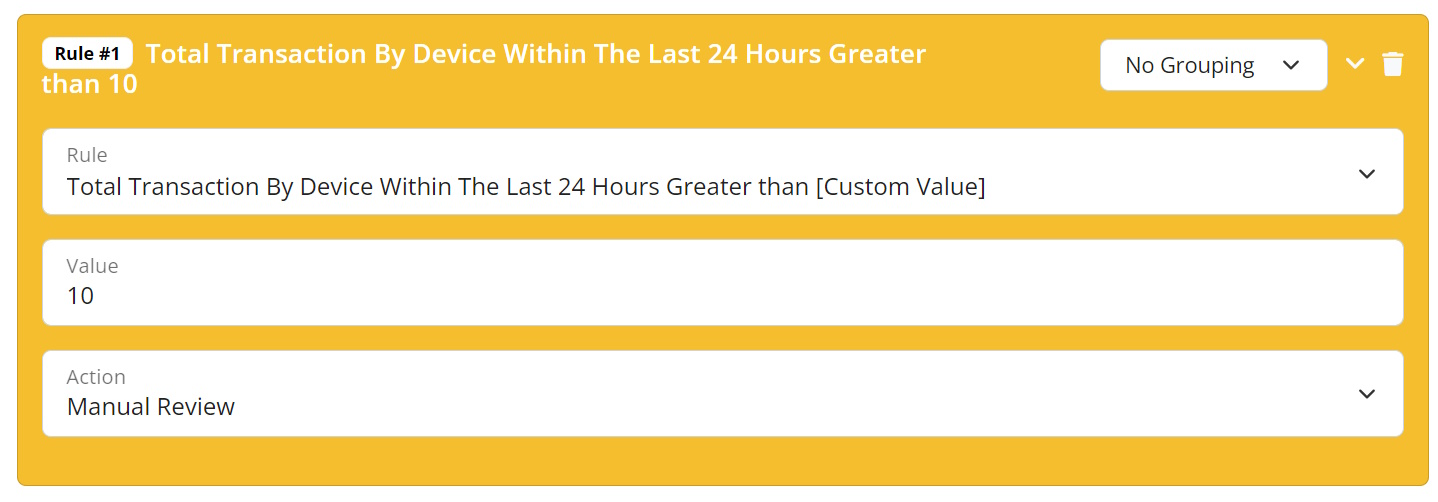

Use Device Fingerprinting Rule

If the device validation is equal to the blacklisted device, reject the order.

If total transaction by device within the last 24 hours greater than specified value, review the order.

Conclusion

Identity theft presents a significant risk in the contemporary interconnected world. However, individuals can proactively shield themselves from this threat by familiarizing themselves with the typical tactics used by identity thieves and taking some precautionary actions. Meanwhile, online merchants should use the FraudLabs Pro fraud screening service to protect their stores from fraudsters.

Free Fraud Protection Today!

Start safeguarding your business with FraudLabs Pro Fraud Prevention at Zero Cost!