Introduction

In this tutorial, we would like to share with merchants some common techniques to pinpoint red flags of credit card frauds. Our goal is to cut down all frauds and chargebacks.

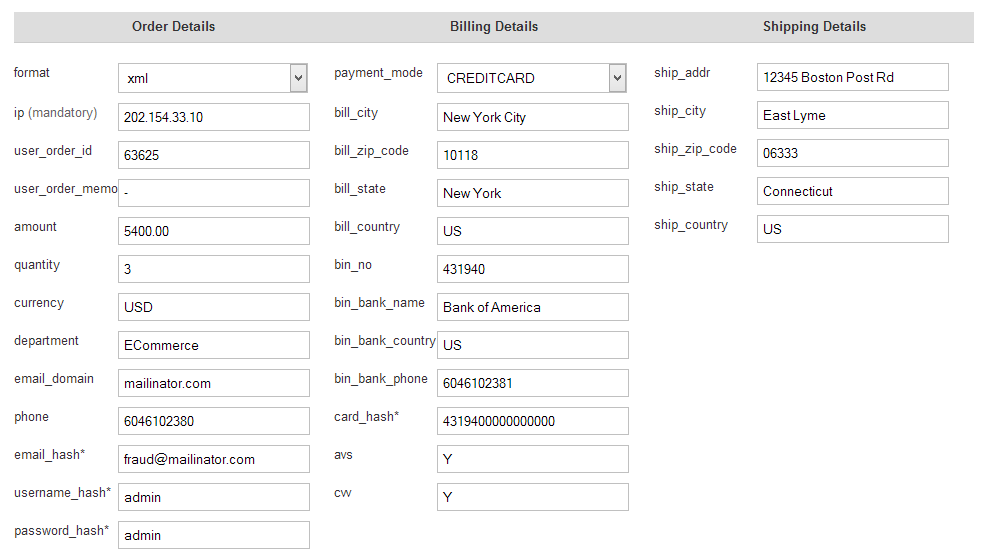

John is an online merchant selling watches. Below is one of his typical order. Everything looks fine to him but we would like to highlight some important information to help him make an informed decision.

IP Address

The IP address is from an anonymous web proxy service. It allows the user to hide their actual IP address but still perform an order submission. In this case, the actual user IP address is unknown and we only know the proxy server’s IP address.

If we analyze the user’s IP address, it is located in a different country which is 1,000 miles away.

Amount and Quantity

The order and quantity are also above average transaction values. Fraudsters will usually order large quantities of items to maximize their returns.

Addresses

The shipping address is being listed as one of the forwarding service providers. The actual item will be forwarded to another address for collection upon fraudster’s further instructions.

The shipping address, billing address and IP address locations are all totally different. In this case, the fraudster is using a proxy server, mail forwarder and stolen credit card to avoid tracking.

Email Domain

The order is being submitted using a disposable email address. The email address is easy to setup, anonymous and temporary.

Username and Password

The user name and password is too simple and generic. Fraudsters usually apply easy-to-remember account information.

Credit Card

The credit card number has been blacklisted due to prior exposure in public area. The fraudster purchased this credit card information from underground trading forums.

BIN and Issuing Bank

The BIN number and issuing bank name do not match. Fraudsters usually only have partial credit card information except for the issuing bank information.

There are many other techniques that are not readily apparent when looking at the order forms such as transaction velocity and device fingerprints, both of which can also unmask a serial fraudster.

If you do not have the time to process these techniques for all orders, you can consider the FraudLabs Pro fraud service which is free for small businesses.

FraudLabs Pro service screens credit card transactions for online frauds. It accepts online transaction data via its open API. Fraud screening engine analyzes transaction parameters and returns its fraud analysis. Merchants can then decide on the next course of action based on the fraud distribution score or custom rules by conditions. Below are some features of FraudLabs Pro.

- Fraud analysis and scoring

- IP address geolocation & proxy validation

- Email address validation

- Credit card issuing bank validation

- Transaction velocity validation

- Device transaction validation

- Blacklist validation

- High risk username & password validation

- Export controlled country validation

- Malware exploit validation

- Custom rules trigger

- FraudLabs Pro Merchant Network

- FraudLabs Pro Merchant Administrative Interface

- Email notification of fraud orders

- Mobile app notification of fraud orders

Download this article in PDF version.

Ready to start with FraudLabs Pro?

Get Micro plan for free, you can quickly explore and integrate with our fraud prevention solution in minutes.