Introduction

Credit card fraud cases are on the rise and causing huge losses to merchants. The merchants that sell goods and services over the Internet are suffering big losses through the chargebacks from the financial institutions who serve the targeted credit cardholders. Merchants who offer a product or service online have to take the risk of losing the cost of the product sold online, plus the added cost of chargeback fees, and they even have to face the possibility of having their merchant account terminated by the financial institutions serving them.

One of the possible solutions to minimize credit card fraud is to compare the country of the credit card issuing bank against the country of the billing address. If both the country of billing and card issuing bank are the same, it’s more likely the transaction is from a legitimate buyer. And, by combining with other elements check, such as anonymous proxy validation, disposable email validation, this approach could act as the first gate to effectively weed out those fraudulent orders before sending to the payment gateway for processing.

Determining The Issuing Country of a Credit Card & Billing Country

In this tutorial, we will discuss how to use the validation rule in FraudLabs Pro to help you to detect if the credit card issuing country is not the same as the billing country. Also, the page where you can view the fraud insight result pertaining to the credit card risk analysis.

Before we begin, how can we determine the issuing country of a credit card? The answer lies in the first 8 digits of the credit card BIN/IIN number. This BIN/IIN code can provide you with information about the issuing bank, the country it is from, and the card type. You can try out our demo tool, Credit Card BIN or IIN Lookup, or visit the article What is Credit Card BIN (IIN) and how do I retrieve this information for fraud validation to learn more.

Therefore, in order to detect the credit card issuing country with the billing country, the BIN information must be supplied into FraudLabs Pro API via the bin_no parameter, or provided by the e-commerce platforms if you are using our ready plugin.

However, this piece of information is not made available in all plugins. If you are using the FraudLabs Pro ready-made plugin for Shopify, WooCommerce, Magento, OpenCart, WHMCS, ZenCart, PinnacleCart, osCommerce and nopCommerce, then yes, the BIN data will be automatically retrieved from the order transaction for validation.

Of course, in addition to BIN information, the billing information, particularly the billing country, must also be supplied to FraudLabs Pro for the comparison check.

How to Configure A Fraud Validation Rule

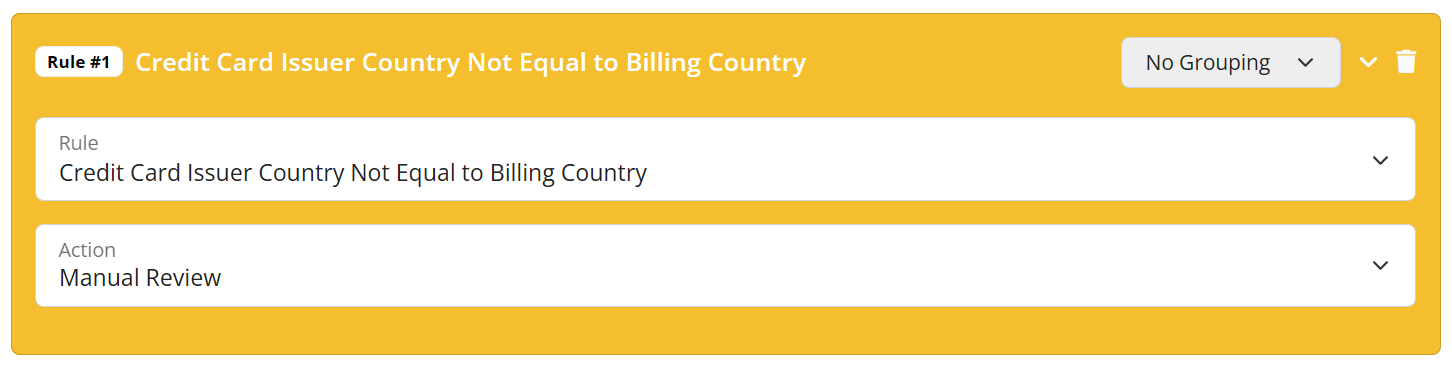

If you have both BIN/INN and billing information, you can create a fraud validation rule on the FraudLabs Pro Rule page. This rule will perform the necessary check and trigger an action, such as reviewing or rejecting a transaction.

- Login to your FraudLabs Pro Merchant Area.

- Go to Rule page.

- Click on Add Rule.

- Then select Credit Card Issuer Country Not Equal to Billing Country for Rule field.

- Choose Manual Review for Action field then save it.

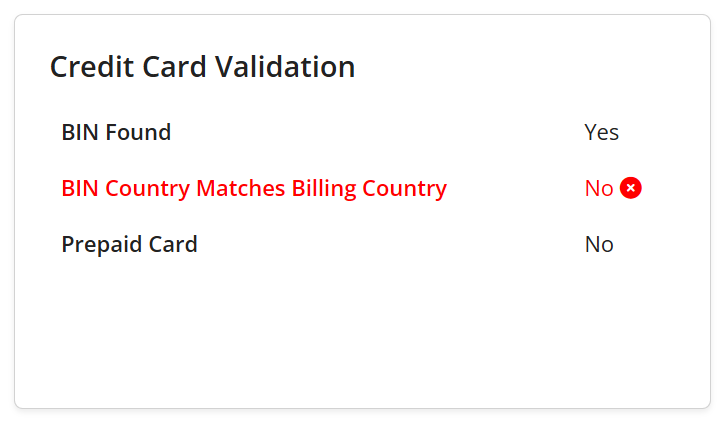

After the order has been screened by the FraudLabs Pro system, the transaction details page will display the result of the credit card issuing country and billing country checking. There is an indicator under the Credit Card Validation section that shows the result. The screenshot below provides an example of the indicator.

It is highly recommended that merchants conduct manual reviews of transactions when the credit card issuing country DOES NOT match the billing country.

This manual review is crucial for several reasons:

Fraud Detection: Carefully examining transaction details helps in detecting potential fraud.

Regulatory Compliance: Ensures compliance with different regulations and restrictions on cross-border transactions.

Customer Verification: Confirms the accuracy of billing information and reduces the risk of unauthorized transactions.

Enhanced Security: Identifies suspicious patterns or anomalies that may indicate fraudulent activity.

By implementing these manual review procedures, merchants can effectively mitigate fraud risks and ensure the security of their transactions.

Conclusion

In conclusion, while it is impossible to completely eliminate online credit card fraud, there are steps you can take to minimize it. Merchants can utilize fraud prevention services like FraudLabs Pro to effectively manage orders and reduce credit card fraud.

Free Fraud Protection Today!

Start safeguarding your business with FraudLabs Pro Fraud Prevention at Zero Cost!