A prepaid card, also known as a prepaid payment card, is a financial tool that allows cardholders to load a specific amount of money onto the card before using it for purchases or transactions. The card operates similarly to a debit or credit card, enabling users to spend up to the available balance on the card.

Prepaid cards are gaining popularity, with a recent Allied Market Research report projecting transaction volumes to reach $14.4 trillion by 2032. As the popularity of prepaid cards has grown, so has the incidence of fraudulent activities associated with them. Fraudsters often exploit the anonymity offered by prepaid cards to carry out their illegal activities, such as money laundering or identity theft. The lack of direct linkage to a bank account makes it more challenging for authorities to trace and recover funds in case of fraudulent transactions.

Hence, when considering prepaid cards from a merchant’s perspective, it is crucial to be aware of the potential risks associated with them, especially the anonymity. This anonymity can pose challenges for merchants in verifying the legitimacy of the cardholder. Furthermore, prepaid cards are susceptible to fraudulent activities like chargebacks or unauthorized transactions, primarily because the funds are not directly linked to a bank account. Therefore, merchants need to stay vigilant and proactive in detecting and preventing prepaid card fraud. Implementing robust fraud detection systems, conducting thorough identity verification checks, and monitoring suspicious transactions can help minimize the risks.

Most Common Scams Involving Prepaid Card

Fraudsters not only purchase prepaid cards with stolen credit card information or directly steal prepaid card numbers, but they also frequently use prepaid cards in various financial scams. Here are some common types of fraud and scams that typically involve prepaid cards:

Advance Fee Scams: Victims are promised large rewards such as a big payout, or prize if they pay a small fee upfront, usually for taxes or shipping. Fraudsters might pose as foreign officials or fake lottery organizers, instructing victims to send money via prepaid cards to unlock their prize.

Skimming: It occurs when fraudsters steal the magnetic stripe data from prepaid cards. This information is then copied onto a new card, which is activated and used for fraudulent transactions. Skimming can happen in places like restaurants, stores, and so on.

Card Swaps: Fraudsters engage in card swapping by stealing prepaid card packs from store racks. They then replace the genuine cards inside with fake cards, reseal the packaging, and return the tampered cards to the shelf. When the fake cards are activated, the fraudster uses them to make purchases.

Tax Fraud: It involving prepaid cards happens when criminals use stolen or synthetic identities to file fraudulent tax returns. Refunds are issued via prepaid cards, which are then accessed by the fraudsters.

How to Detect a Prepaid Card in FraudLabs Pro?

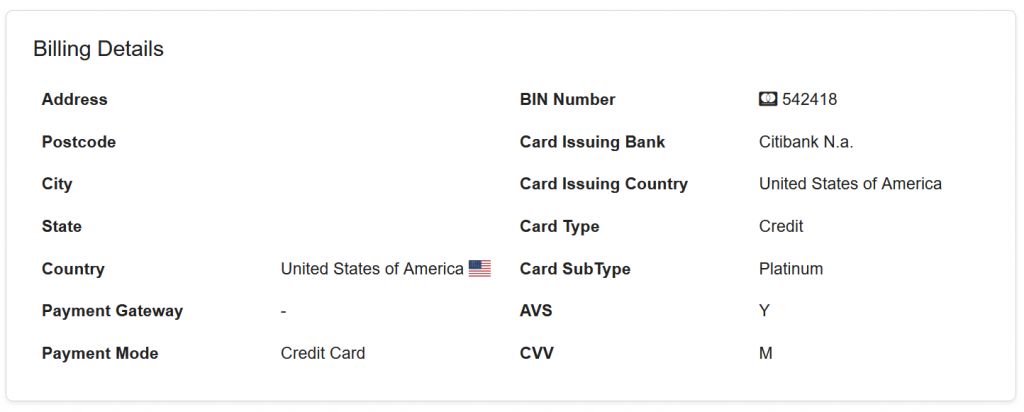

A prepaid card can be identified by using the 6 or 8-digit card BIN/IIN number. This BIN/IIN number contains important information about the card, including the issuing bank, issuing country, card type, and card subtype. The card type indicates whether it is a credit or debit card, while the subtype provides more detailed information about whether it is a prepaid card, gift card, corporate card, and so on. You can visit the Credit Card BIN Lookup online tool to learn more.

To create a rule for detecting or blocking prepaid cards in FraudLabs Pro, it is important to ensure that the BIN information is available. You can accomplish this by visiting the transaction details page and locating the BIN information. It should be noted that not all e-commerce platforms provide the card BIN information, so availability may vary.

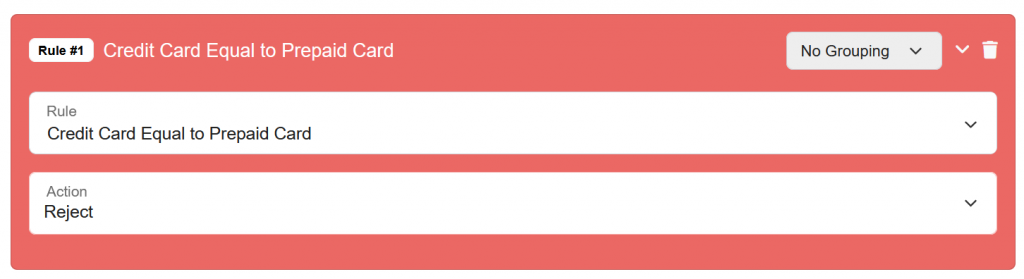

If the BIN information is presented on the transaction details page above, you can proceed to create a rule to check for prepaid cards on the Rules page. To find the validation rule, search for the name “prepaid”. You should see a validation rule named “Credit Card Equal to Prepaid Card”. Based on your requirements, you can decide the next course of action, such as to put the transaction into review or to reject it immediately.

Should I Block The Prepaid Card From The Checkout?

Although it is generally advised to refrain from accepting prepaid cards due to their anonymous nature, it is important for merchants to find a middle ground. For example, for recurring buyers, you can lift the restriction on prepaid card usage. Instead of immediately rejecting a transaction, you could consider performing additional authentication, such as a phone call or SMS verification, to confirm their true identity. They should consider accepting prepaid cards as a legitimate form of payment while also implementing robust security measures. By doing so, merchants can safeguard their businesses and customers against the potential risks associated with prepaid card fraud. It is crucial for merchants to strike a balance between convenience and security, ensuring that their payment policies align with the best interests of their business and customers.

Free Fraud Protection Today!

Start safeguarding your business with FraudLabs Pro Fraud Prevention at Zero Cost!