FraudLabs Pro allows user to configure multiple fraud validation rules with multiple actions, such as Approve, Manual Review, and Reject. But, how is the sequence of execution if you had configured multiple validation rules with different actions? Below are the explanation of the execution logic.

FraudLabs Pro adopts an easy-to-understand sequential checking for the validation rules. It basically checks the validation rules starting from the 1st rule to the last one in the sequence. If the system found the match during the sequential check, it will stop the checking process and flag the transaction based on the action defined. However, if the system completed the sequential check with no match found, it will flag the transaction as Approve. It’s as simple as explained. Below is the summary of the validation logic:

- If match found during the sequential check, stop the checking process and flag the transaction based on the action defined, such as Approve, Manual Review or Reject.

- If sequential check completed with no match found, flag the transaction as Approve.

Example of validation scenarios.

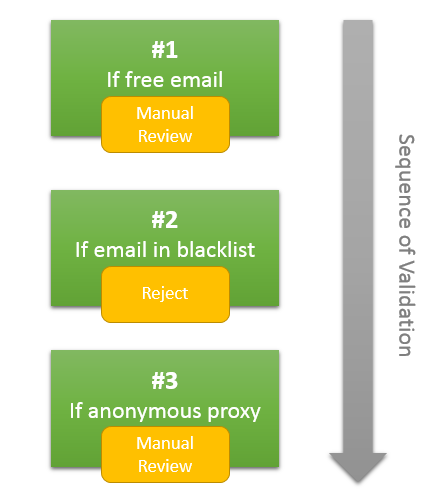

Assuming you created 3 validation rules for Free Email, Email in Blacklist and Anonymous Proxy as above.(Note: to ease the explanation, this tutorial will not display the exact rule name but a short representation)

Scenario 1: User’s email address is a yahoo email.

The validation process will be stopped at Rule #1 and the transaction will be flagged as Manual Review.

Scenario 2: User’s email address is a company email but had been previously blacklisted by FraudLabs Pro.

Rule #1 pass the validation. However, the validation process will be stopped at Rule #2 and the transaction will be flagged as Reject.

Scenario 3: User’s email address is a company email with clean record, and not using Anonymous Proxy.

The validation process completed successfully and the transaction will be flagged as Approve.

Have you created your fraud validation rules?

Ready to start with FraudLabs Pro?

Get Micro plan for free, you can quickly explore and integrate with our fraud prevention solution in minutes.